The energy storage market is accelerating, what will manufacturers compete for in the future?

These include the second largest wind turbine manufacturer in China and the top 10 lithium power battery manufacturers in the world.

More new entrants

More new entrants appear in this year’s list of energy storage industry technology alliances, many new energy storage technology providers and lithium battery energy storage system integrators are already in the top ten.

The rise of energy storage businesses dominated by wind power, photovoltaics, and hydropower highlights that giants in the new energy industry are expanding the field of energy storage, and the competition in the energy storage market is changing.

New battlefield

Giant’s new battlefield for new energy storage, especially lithium battery storage systems

In the past, power battery manufacturers in the new energy vehicle industry occupied a leading position in the lithium battery energy storage market, and their typical representatives were CATL and BYD.

This is mainly due to the key position of lithium batteries in energy storage systems.

According to the report of the Energy Storage Industry Technology Alliance, by the end of 2021, the cumulative installed capacity of new energy storage in the world is 25.4GW, and lithium battery energy storage accounts for 90.9%. Among them, China’s cumulative installed capacity of new energy storage is 5.76GW, and lithium battery energy storage accounts for 89.7%.

Benefiting from the rapid development of new energy vehicles in recent years, its core components, lithium battery technology, have rapidly improved and costs have been reduced.

According to data from Bloomberg New Energy Finance, in the ten years from 2010 to 2020, the global average price of lithium-ion battery packs dropped from $1,100/kWh to $137/kWh, a drop of nearly 90%, driving the cost of energy storage systems to drop by 75% .

From 2019 to 2021, the power battery leader CATL ranked first in the domestic new energy storage market in terms of shipments of energy storage batteries for three consecutive years. In 2021, CATL will be the Chinese manufacturer with the largest shipment of energy storage batteries in the global energy storage market.

In 2020, other Chinese manufacturers that originally only focused on energy storage batteries and energy storage systems in overseas markets also announced that they would actively participate in the domestic energy storage market.

As a leader in the domestic power battery industry, CATL has lithium iron phosphate battery technology and production lines suitable for development in the field of energy storage. The energy storage business was strategically laid out very early: At the beginning of the establishment of the CATL, two strategic directions of power battery and energy storage were established.

The forward-looking strategic layout and the technological and production capacity advantages in lithium iron phosphate have made CATL and others, as representatives of power battery manufacturers, quickly stand out in the field of energy storage.

Some companies entered the battery energy storage field earlier in 2008.

The earliest companies in the new energy industry to enter the energy storage field are photovoltaic inverter manufacturers.

Since inverters and energy storage converters (PCS) are both power electronic devices, their functional orientation is to convert AC and DC, and they are technically connected. Inverter manufacturers naturally enter the field of energy storage converters.

In the new ranking of global energy storage converters in 2021, three of the top five Chinese manufacturers are also the top photovoltaic inverter manufacturers. Some of them have been vigorously developing energy storage business since 2014, while the rapid rise of some lithium energy storage manufacturers is related to their overall technology accumulation and business layout.

For example, in the field of distributed building energy storage, which provides energy storage systems for distributed buildings solution.

However, some manufacturers officially expanded in the field of energy storage until 2019, and developed dedicated energy storage cells.

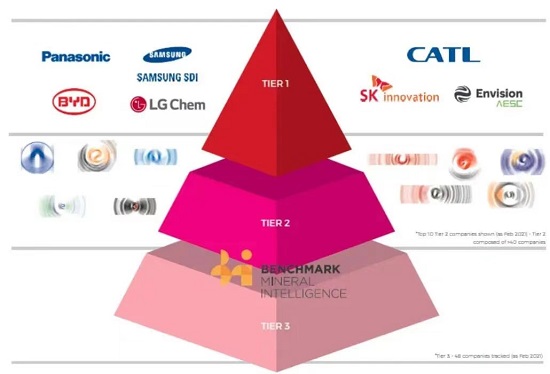

Benchmark reports on battery energy storage rank

Benchmark released the 2021 global automotive battery supplier rating report, and CATL and Envision AESC are the first-tier suppliers.

With the close contact with new energy developers, energy storage battery manufacturers can better develop the new energy distribution and energy storage market. Based on industry-leading energy storage products and system solutions, and rational adjustment of market strategies, the energy storage business began to explode.

The top three wind turbine manufacturers are all stepping up the development of energy storage and getting involved in the field of energy storage. At the Energy Storage International Summit last October, TC released the Energy Brick, a modular energy storage integrated cabinet.

MY has also increased its investment in the energy storage business. Its subsidiaries have developed PCS, EMS, BMS and other core battery energy storage components, and have strategically cooperated with CATL on lithium battery cells and packs.

Among photovoltaic cell and module manufacturers, TH Solar’s energy storage business ranks at the forefront, and its subsidiary energy storage company ranks tenth in China’s domestic energy storage system shipment ranking in 2021.

What’s next ?

Energy storage projects are not yet able to operate independently and commercially. The “Implementation Plan for New Energy Storage Development” proposes to study the establishment of a new energy storage price mechanism, and to study a reasonable cost allocation and dredging mechanism, but it has not yet been fully implemented.

One path that can be achieved is to quickly reduce costs through BESS energy storage, and ultimately achieve parity or low prices between wind power/photovoltaic plus energy storage and coal power.

The “New Energy Storage Development Implementation Plan” clearly states that by 2025, new energy storage will enter the stage of large-scale development from the initial stage of commercialization, and will have the conditions for large-scale commercial application. Among them, the performance of electrochemical energy storage technology is further improved, and the system cost is reduced by more than 30%.

The Energy Storage Industry Technology Alliance predicts that by 2025, the cost of lithium iron phosphate (LFP) kWh can be reduced to between USD 0.027-0.04/kWh.

It is expected that by 2025, wind power and photovoltaics will further reduce the cost of electricity on the basis of achieving parity. By then, wind power and photovoltaic energy storage in most regions will achieve grid parity.

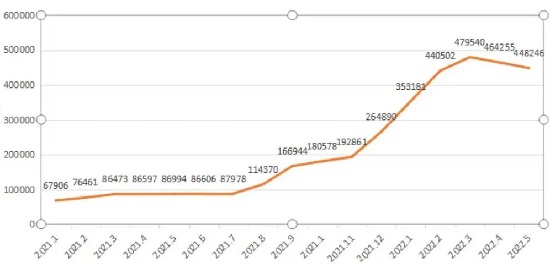

However, the price increase of battery raw materials since last year has disrupted the pace of cost reduction in energy storage. From the beginning of 2021 to May 2022, the price of lithium carbonate has soared by as much as 633%.

Price of lithium carbonate since 2021

This directly pushes up the winning bid price of energy storage projects. New energy projects with strong energy storage are facing profitability challenges, and the gross profit margin of energy storage manufacturers is also declining.

Affected by rising energy storage prices, this year’s energy storage projects may be delayed as a whole. Cost reduction is an urgent need for the industry in the short term or in the medium and long term.

Since the energy storage battery pack accounts for as much as 60% of the cost of the energy storage system, the cost reduction of energy storage requires a substantial cost reduction of the energy storage battery. This means that energy storage manufacturers that can develop and produce energy storage batteries will have more advantages in the future energy storage cost reduction competition.

A trend of energy storage manufacturers is to build the entire industry chain, especially the R&D and manufacturing capabilities of batteries. This can not only optimize the entire industry chain in technology research and development, design and manufacturing, and ensure performance and quality, but also minimize costs.

Most of the top ten energy storage manufacturers have built full-stack technology capabilities ranging from batteries, PCS, BMS, EMS to system integration.

The CATL’s energy storage system integration shipments ranked out of the top ten, but it has mastered system integration technologies such as unified regulation of large-scale energy storage power stations and battery energy management, which can provide everything from cell components to complete energy storage battery systems in entire series of products.

In May of this year, TH Energy Storage announced that it will invest in the construction of a lithium iron phosphate battery factory in China, which means that TH Energy Storage has also entered the ranks of its own R&D and production of energy storage batteries.

New trend

In addition to cost reduction, another trend of energy storage is to increase revenue.

Energy storage cannot be independently commercialized yet, but independent commercial operation is the general trend.

In April this year, Shandong announced the 2022 energy storage demonstration project. Shandong intends to promote the entry of energy storage facilities into the power market. These demonstration energy storage power stations are just to try out an independent business model for energy storage power stations.

In the second batch of energy storage demonstration projects exceeding 3.1GW, YJ Energy, as an investor, obtained the 100MW/200MWh energy storage power station quota.

The essence of energy storage is trading, and energy storage that can be traded will represent the future.

The goal of energy storage manufacturers is to invest and operate energy storage power stations by themselves, and rely on the cloud’s tripartite data to form charging and discharging, so as to practice the technology and concept of energy storage smart transactions.

The first is the production data of the status of the connected wind power, photovoltaic and energy storage equipment monitored by the regional centralized control; the second is the predicted new energy power generation; electricity price forecast.

The optimal charging and discharging strategy means optimal revenue, and energy storage can be charged when the electricity price is the lowest and sold when the electricity price is the highest.

Since the price of electricity reflects the actual power peak-to-valley difference, the optimal charging and discharging strategy can actually play the greatest role in stabilizing the power peak-valley difference and ensure the safe and stable operation of the power system.

Recently, China’s National Energy Administration has requested to accelerate the full participation of the user side in spot market transactions, and to accelerate the promotion of various types of qualified power sources to participate in the spot market.

This “request” clears policy obstacles for energy storage to participate in the spot market as an independent market player. In the future, a core competitiveness of energy storage manufacturers will be the able to provide optimal trading strategies.

CATL is also exploring various energy storage business models. The Jinjiang energy storage power station on the grid side it participated in is the first independent lithium battery energy storage power station in China to obtain a station power generation license.

Other manufacturers have also been exploring independent commercial operation models for domestic energy storage plants in China. In the future energy storage market, the cost and performance of energy storage battery, PCS, and system integration as hardware are still very important. At the same time, with the advancement of the electricity spot market, the soft power of energy storage power stations, such as trading strategies and operational capabilities, will become more and more important.

This means that in order to adapt to the rapid development of the energy storage market, energy storage manufacturers need to have comprehensive software and hardware capabilities at the same time in order to build a competitive advantage at both cost and income ends.