The price of battery-grade lithium carbonate rose slightly, and the price of lithium hexafluorophosphate is expected to stop falling

Since June, the price of lithium carbonate has returned to an upward trend. Industry analysts pointed out that the tight supply of lithium concentrate and the increase in market demand for new energy vehicles have supported the high and volatile price of battery-grade lithium carbonate, which has also contributed to the continued decline in prices since early March. The price of lithium hexafluorophosphate brings hope of stopping the decline.

Lithium hexafluorophosphate prices are expected to stop falling

According to the data, due to the increasing demand in the new energy industry and the tight supply of lithium resources, the average price of battery-grade lithium carbonate in the Chinese market in the first quarter was US$63,000/ton, a year-on-year increase of 456%.

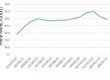

From the end of the first quarter to the first ten days of April, the price of battery-grade lithium carbonate once exceeded US$74,600 per ton. The price began to fall in mid-April, and the price continued to decline in May, but the average price basically remained above US$67,000 per ton. Since June, lithium carbonate prices have returned to an upward trend.

In June, the price of battery-grade lithium carbonate rose slightly. Last week, the spot price of battery-grade lithium carbonate increased by USD 597/ton.

The latest market data shows that on June 14, the quotation of battery-grade lithium carbonate was basically in the range of US$68,600/ton to US$72,400/ton.

Industry analysts pointed out that the tight supply of refined lithium ore and the increase in market demand for new energy vehicles have supported the high and volatile price of battery-grade lithium carbonate.

According to data, from January to May, the production and sales of new energy vehicles in China were 2.071 million and 2.003 million respectively, an increase of 1.1 times year-on-year, and both exceeded 2 million; the cumulative installed capacity of power batteries was 83.1GWh, a cumulative year-on-year increase of 100.8%.

High price

The price of lithium salts such as battery-grade lithium carbonate remained high, which greatly boosted the performance of listed companies in the related industry chain.

As the prosperity of the lithium industry continued to recover in the first half of the year, the demand for lithium salt products continued to grow, and the price of lithium salt products continued to remain at a high level.

In addition, the rise in the price of battery-grade lithium carbonate has also brought hope for the price of lithium hexafluorophosphate, which has been falling since the beginning of March, to stop falling.

In the short term, the drop in the price of lithium hexafluorophosphate in the second quarter was due to the impact of the epidemic on demand. The current cost of lithium carbonate supports the price of lithium hexafluorophosphate, and the supply and demand structure has improved from the third quarter. The selling price has reached a periodical low point, and the profitability of electrolytes has become more certain.

Data show that on June 13, lithium hexafluorophosphate stopped falling, with an average price of US$37,800/ton. Since June, with the gradual resumption of production and work by downstream manufacturers, the overall new energy industry chain has gradually recovered, and the demand for lithium hexafluorophosphate has also increased.

Returning to rationality

The price of lithium hexafluorophosphate has also stabilized recently, and the price is gradually returning to rationality.

The lowest price of lithium hexafluorophosphate in July 2020 was less than US$11,000/ton. At the beginning of this year, the price once approached US$89,000/ton. In mid-May, the price fell below US$45,000/ton. The current average price is about US$37,000/ton, which can be described as a roller coaster style of ups and downs.

However, although the price of lithium hexafluorophosphate has been greatly reduced, it still does not affect the investment confidence of enterprises.

In general, under the support of the price of lithium carbonate and with the gradual release of new production capacity, the market price of lithium hexafluorophosphate is expected to fluctuate greatly.

However, the previous low price below US$15,000/ton and the high price of US$75,000/ton are difficult to reproduce, and returning to rationality will become the new normal in the industry.

Leading companies with advantages in technology, cost and scale will further enhance their profitability in the future.