New batch of lithium battery industry chain companies benefit from IPO

According to incomplete statistics, since 2022, nearly 20 companies in the lithium battery industry chain have been preparing for IPOs, including lithium battery, battery materials, and lithium battery manufacturing equipment providers.

The total amount of funds to be raised exceeds 20 billion yuan, most of them are lithium battery material manufacturers

In recent years, with the expansion of lithium battery production, the lithium battery industry chain as a whole has ushered in a period of prosperity, and high-quality companies in the industry chain are entering the capital market one after another to further expand with capital.

This round of IPOs by companies in the lithium battery industry chain also shows the development and evolution of the lithium battery industry.

Demand surged

The demand for lithium battery materials has surged, and competition has intensified, prompting fundraising to expand production.

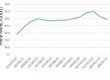

Due to the acceleration of the global industrialization of electric vehicles and energy storage, the demand for lithium batteries has surged, and the competition for production capacity has become increasingly fierce.

The total battery production capacity planned by the world’s leading lithium battery companies by 2025 has exceeded 3.5TWh.

It is estimated that by 2025, the global demand for cathode materials will reach about 6.3 million tons, the demand for anode materials will reach about 4.2 million tons, the demand for separator will be about 52.5 billion square meters, and the demand for electrolytes will be about 3.5 million tons.

Industry response

In response to the shortage of upstream materials and equipment, battery companies have signed large and long orders with material and equipment companies to lock in supply.

The main customers of the lithium battery industry chain companies that plan to IPO this year are mainly battery manufacturers such as CATL, Guoxuan Hi-Tech, Yiwei Lithium Energy, BYD, and Honeycomb Energy.

This also shows that orders from battery companies have surged, causing supply chain companies to speed up expand production.

Tongguan Copper Foil said that its PCB copper foil production growth rate was slightly lower than the industry level.

In the future, if the company cannot successfully expand the production capacity of PCB copper foil, its production capacity and output may be adversely affected, which may affect its increase in the market share of PCB copper foil.

Therefore, the 3.579 billion yuan raised by the IPO will be mainly used for copper foil-related projects.

On the whole, the production capacity advantage still plays a crucial role in the market share index of the company’s products.

Financing

Most of the lithium battery industry chain companies in this round of IPOs are going to invest in ternary precursors, cathode and anode electrodes materials, electrolyte, copper foil, etc.

The listing and fundraising will further expand the production capacity of mainstream technology products such as high nickel and lithium iron phosphate.

In terms of lithium battery materials, based on the update of mainstream battery technology, battery raw materials such as high nickel and lithium iron phosphate have great advantages in material characteristics, resource reserves and costs, and are favored by battery companies and OEMs, and heavy volume market demand continues.

HY, a leading enterprise in the field of lithium iron phosphate in China, will vigorously increase its lithium iron phosphate project in its Sichuan base. Hubei Wanrun, as one of the leading lithium iron phosphate enterprises, has also successfully IPOed and expanded its production of lithium iron phosphate.

Tengyuan Cobalt, which has raised 5.478 billion yuan, will be mainly used for the construction of nickel, cobalt and other related projects.

In addition, the upgrading of new materials such as electrolytes and anodes also requires a lot of capital to support production.

Expansion driver

Technological iteration, cost reduction and efficiency increase put forward higher requirements for equipment companies to expand production.

The continuous iteration of new technologies in the battery industry has brought challenges to lithium battery equipment companies and brought new opportunities to break through. There are also higher requirements for battery coating, winding, PACK and other production processes.

In addition, with the needs of battery technology iteration and cost reduction and efficiency enhancement, the single-line production capacity of power lithium batteries is moving from 2-3GWh to 5-6GWh, or even 10 GWh, which will drive lithium battery equipment companies to collaborate in the research and development of new processes, new technologies, and new technologies.

With the update and iteration of equipment, companies that can take the lead in developing and expanding new processes, new technologies, and new equipment will receive market returns.

Potential opportunities

The diversification of orders has provided opportunities for more potential second-tier companies to develop.

Due to the strong demand in energy storage, 3C and other fields, the products of some second-tier lithium battery companies have also been favored by the market, and their domestic market share is expected to increase.

Some IPO battery companies have focused their planned expansion on portable energy storage battery products and consumer battery products.

Summary

The capital market provides strong support for enterprises in terms of production expansion, R&D, sales and replenishment of working capital.

With the support of capital, the expansion of production will be accelerated, which will help the industry to increase in quantity and make a qualitative leap.

At the same time, competition will also become fierce, and backward and excess production capacity may be eliminated at an accelerated pace.

In addition, a number of lithium battery industry chain companies, including battery companies such as Honeycomb Energy and Tafel, and material companies such as Dacheng Precision, are in the stage of listing counseling or filing materials, and are expected to officially launch their IPOs within this year or next year.