Earlier, Goldman Sachs published a forecast that cobalt and lithium prices will drop sharply in the next two years, and the battery metal market immediately shook.

But London-based Benchmark Mineral Intelligence has publicly rebutted, outlining the reasons it believes lithium price forecasts are wrong.

US analyst Wood Mackenzie also said that the battery raw material chain will continue to be tight, but pointed out that the recycling of battery metal raw materials may help alleviate the shortage of supply.

Lithium Battery Metal Materials

Tighter supplies

The accelerating global energy transition is driving tighter supplies of key battery raw materials such as lithium

At the end of May, Goldman Sachs, an American investment bank, predicted that the prices of three key battery materials, cobalt, lithium and nickel, would fall in the next two years due to the rapid influx of investors, causing shocks in various lithium battery metal stocks.

The electrification of transportation has created a severe shortage of lithium-ion battery materials, causing raw material prices to soar.

But Goldman Sachs declared in its report that the bull market in battery metals was “over for now.” Goldman Sachs expects lithium prices, currently just under $54,000 per ton, to plummet to $16,372 in 2023.

Meanwhile, cobalt prices will drop from around $78,500 per ton now to an average of $59,500 next year. Nickel prices should remain relatively flat from $31,000 per ton now to $30,250 next year.

For the rest of the year, however, Goldman Sachs expects nickel prices to rebound to $36,500 per ton before an inflection point.

Analysts expect lithium supply to grow by an average of 33% annually between 2022 and 2025, reflecting increases in new project starts in Australia, China and Chile. Cobalt will increase by 14% year-on-year and nickel by 8% year-on-year, while the annual demand growth rates of the three are 27%, 11% and 7% respectively.

Different views

But some industry watchers, such as Benchmark Mineral Intelligence, strongly disagree. They point out that Goldman’s forecast is highly unlikely to happen. Instead, the lithium market will remain in a structural deficit until 2025.

Benchmark said: “As the market wrestles between the long-term security of supply that fuels new economies such as EV lithium batteries and energy storage lithium batteries, and increasingly market-led pricing mechanisms that will incentivize supply growth, an era of volatility in the lithium market may just started.”

They see five reasons Goldman’s conclusions are wrong:

- The quality of China’s lithium resources is not high, and the lithium battery industry cannot rely on China’s raw materials to meet market demand.

- Lithium material capacity does not equal actual supply – there is a time period from start to market, and rarely goes according to plan.

- New lithium supply has higher cost structure

- There is no single lithium price – spot and contract prices in the lithium market take time to balance

- A large proportion of the converted lithium capacity from chemical plants represents only lower quality lithium capacity, not new qualified lithium capacity

Unavoidable huge waste

Regardless of the pace of expansion of the battery supply chain, the consensus is that cumulative global capacity will grow at an unprecedented rate throughout the decade.

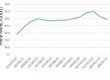

According to the data, between 2021 and 2030, the cumulative global lithium-ion battery capacity could increase more than fivefold to 5,500 GWh.

Supply will not be able to keep pace with demand until 2023. One of the ways to alleviate the pressure of insufficient supply of battery raw materials is to recycle used batteries.

The current demand for major battery raw materials is: 97 kilotons of lithium, 186 kilotons of cobalt, and 3014 kilotons of nickel, and by 2030 these are expected to grow to 318 kilotons, 264 kilotons and 4273 kilotons, respectively.

However, by the end of the decade, supplies from recycled materials are expected to reach 130 kilotons of lithium, 112 kilotons of cobalt, and 377 kilotons of nickel.

Some existing difficulties

However, recycling battery raw materials currently faces challenges.

- First, recycling cathodes rich in key metals is not an easy task, as it is wrapped in layers of packaging materials such as casings, interconnects, cooling pipes, and more. Combined with the preference of lithium battery producers to use lower-value materials, the move towards larger EV battery packs also constitutes a deterrent to recycling due to lower battery throughput.

- Second, electric vehicle battery packs have long warranties and longevity. The large-scale emergence of secondary use applications such as residential lithium battery energy storage or industrial and commercial lithium battery energy storage will also make it impossible for scrapped electric vehicle power lithium batteries to enter the recycling system.

Therefore, recycling lithium battery waste will be the main source of recycled materials this decade. Global battery manufacturing capacity is expected to grow 3.5-fold to over 4,621 GWh by 2030, providing a growing market for production scrap.