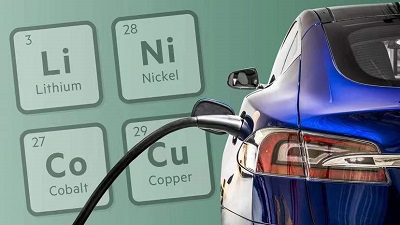

Lithium batteries and supporting metals are driving changes in global mining investment

A qualitative revolution

There will be a qualitative revolution in the power energy market. Under this trend, in addition to the development of local lithium ore, China’s foreign investment in comprehensive raw materials for new energy batteries will become important.

Lithium power has a tendency to replace traditional oil and gas and lead-acid power. The corresponding battery system metals and convenient and efficient conductor metals have become the objects of competition and control by major manufacturers.

Global demand surged

With the global demand for electric vehicle (EV) battery metals surged, in order to prevent being passive in future competition, major power battery manufacturers have tried to control certain metal mines through direct investment, and the corresponding competition has become increasingly fierce.

For example, the US lithium miner “Lithium Americas Corp.” announced this year that it would acquire “Millennial Lithium Corp.” with an offer of US$400 million in stocks and cash, the price is higher than that of CATL, a leading battery manufacturer in China. “Millennial Lithium Corp.” focuses on the lithium mining business in Argentina,

The Lithium Americas and Millennial deal was officially announced in early November this year, which is also one day after the deadline for CATL to respond to this latest offer.

CATL

CATL is the world’s largest manufacturer of electric vehicle power batteries, but it does not produce any lithium itself. As a result of cathode market expectations, Lithium Americas stock immediately rose by 3.5%, while Millennial’s stock fell by about 3%.

In recent weeks, the battle between the Chinese and American companies for Millennial has become heated. However, the person in charge of Lithium Americas said that the fact that Millennial is headquartered in Canada is beneficial to him.

Its CEO Jon Evans told Reuters: “Compared with CATL or other Chinese companies, Millennial is acquired by us. The regulatory risk of this transaction is lower. In any case, the key minerals of the US, Canadian and Australian governments Strategy may play a role in this process.”

He said: “It is expected that CATL will not question the transaction. This is a great expansion opportunity for us in Argentina. Lithium Americas hopes to start construction within two years. The project is expected to produce 24,000 tons of battery-grade lithium carbonate annually in the next 40 years.”

At the same time, despite facing legal obstacles, Lithium Americas is also developing the Thacker Pass lithium mine in Nevada. Evans said: “The company will announce the final feasibility study report on Thacker Pass in 2022.”

SQM

Regarding market changes, SQM, the world’s second-largest lithium miner, said that the average price of battery metals at the end of this year is expected to rise from the previous quarter. Nearly 50%, the reason is that the market’s strong demand for key metals used in the manufacture of electric vehicle batteries continues to put pressure on the market.

Due to the sharp tightening of production capacity in the lithium market, the benchmark lithium price more than doubled in 2021, and China’s lithium price also set a record. The current lithium market is almost zero inventory, and it is expected that the global demand for lithium will increase more than three times by 2025. It is no exaggeration to say that buyers from all walks of life are frantically snapping up all possible lithium ore resources.

SQM and Albemarle, the world’s number one lithium producer, have an annual output of more than 120,000 tons, and will produce 180,000 tons of lithium carbonate and 30,000 tons of lithium hydroxide in Chile by the end of 2022.

SQM said: “The jump in profits is not entirely driven by this ultra-light metal battery lithium, because sales of the iodine and potassium business have also soared during this period. The sales volume this year may be close to 100,000 tons. As previously expected.

Chile

Chile is the world’s largest copper producer and also the world’s largest lithium producer before 2018. As the market expects that China will be the second largest lithium producer in the next ten years, in order to avoid further losing market share, Chile announced in October that it would conduct an international tender for the exploration and production of 400,000 tons of local lithium.

Chile currently produces about 29% of the world’s strong lithium, but plans to double its output by 2025 to approximately 250,000 tons of lithium carbonate equivalent (LCE). It is predicted that the global demand for metallic lithium will quadruple by 2030, reaching 1.8 million tons. At present, Chile’s Atacama region supplies nearly a quarter of the world’s lithium ore (soil).

BHP recently stated: “The demand for battery metals in the next 30 years may increase up to four times the current level. By 2050, the global demand for another battery metal—nickel will quadruple.” From Wood Mackenzie, ING Economics and Bloomberg New Energy financial consultants, including top miners and electric car manufacturers led by Tesla and Volkswagen, expressed similar views.

Because of its high conductivity and durability, copper has always been a necessary component of most wires, power generation, transmission, and distribution circuits.

New energy battery components require copper and nickel metals. The output of these two metals will have to grow exponentially in the next 30 years to meet the needs of renewable energy power generation, electricity storage, electric vehicles, charging piles and related grid infrastructure.

BHP

BHP Billiton actively increased the proportion of “future-oriented” copper, nickel and other assets. BHP Billiton is currently negotiating with Wyloo Metals of Australia on BHP Billiton’s upcoming acquisition of Noront Resources, which owns Eagle’s Nest nickel and copper mines in northern Ontario. This asset belongs to a high-grade nickel mine. It can be seen from this that with the rise of lithium battery energy, the corresponding adjustment in the mining investment market has its inevitability.

As the global cars, mobile phones, drones and smart machines adopt new power battery equipment, this means that the power energy market will undergo a qualitative revolution.

Under this trend, in addition to the development of local lithium ore, China’s foreign investment in comprehensive raw materials for new energy batteries has become important.

Controlling the raw material ore of the battery’s main content metal and supporting metals will become a major trend in global mining and advanced manufacturing competition in the future.