With a large increase in the Chinese market, lithium iron phosphate battery will be “a big change” in 2022.

China’s EV market booms

In November 2021, China’s new energy vehicle market continued to grow rapidly, with sales of new energy vehicles reaching 450,000 units that month, and sales from January to November set a new record of 2.99 million units.

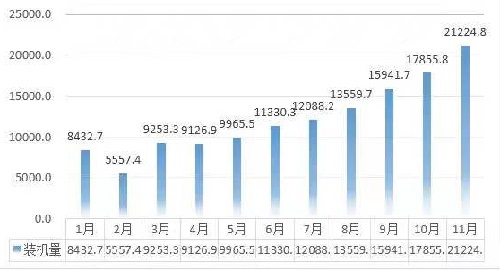

In terms of power batteries, the installed capacity of power batteries in the Chinese market hit a new high of 21.2GWh.

The installed capacity from January to November reached 134.3GWh, a year-on-year increase of 164.4%. Taking into account that the market in December is better, the annual installed capacity of 2021 is fixed at 150GWh, and it will even exceed 155GWh.

2021, the installed capacity of power batteries, Chinese market

From the perspective of the types of supporting vehicles, the installed capacity of passenger cars in the Chinese market in November 2021 is about 18.2GWh, and from January to November is about 119.1GWh; passenger cars only 1.5GWh in November, and 7.2GWh in the first 11 months; special vehicles 11 The month is 1.5GWh, and the first 11 months is 8GWh.

Global installed capacity

The global installed capacity of passenger car power batteries from January to November 2021 is about 250.8GWh.

If the 119.1GWh of passenger cars in the Chinese market is subtracted, it means that the installed capacity of the market outside China will reach 131.7GWh from January to November 2021.

From the perspective of battery form, in the Chinese market from January to November 2021, the installed capacity of prismatic batteries is about 118.1GWh, accounting for 87.9%; the installed capacity of soft-pack batteries is about 8.4GWh, accounting for 6.2%; the installed capacity of cylindrical batteries is about It is 7.9GWh, accounting for 5.9%.

From the perspective of battery types, since August 2021, after the Chinese market has exceeded the installed capacity of ternary batteries, lithium iron phosphate has maintained its lead.

From January to November, the installed capacity of lithium iron phosphate was approximately 67.38GWh, accounting for approximately 50.2%, while the installed capacity of ternary batteries during the same period was 66.73GWh, accounting for 49.7%.

Lithium iron phosphate batteries in the Chinese market have fully surpassed ternary batteries in December. This trend should not change.

Cost pressure

In 2022, subsidies will decline again, and the cost pressure of car companies is expected to increase.

Taking into account the economics of lithium iron phosphate, it is expected that the overall installed capacity of lithium iron phosphate will still be higher than that of ternary batteries in 2022.

In addition, the production capacity of lithium iron phosphate batteries for passenger cars of head battery companies will gradually increase in 2022.

As more leading companies join or even expand lithium iron phosphate battery shipments, it is expected that the proportion of lithium iron phosphate installed capacity will continue to increase in 2022, and the gap between ternary batteries and LIFEPO4 batteries will further widen.

Not only that, but 2022 is also expected to be a crucial year for the introduction of lithium iron phosphate in the international market. International car companies have stated that they may have begun to import lithium iron phosphate batteries.

It is expected that starting from 2022, the installed capacity and market share of lithium iron phosphate in the international market will increase rapidly.

In addition, lithium iron phosphate batteries produced by Chinese battery companies including CATL have also begun to support international car companies, which will further promote the proportion of installed lithium iron phosphate batteries in the international market.

From the perspective of market share, CATL is still thriving, occupying more than half of the market share, accounting for 51.7%;