The evolution of the competitive situation in the power battery industry is evolving, and a new competitive environment may be taking shape.

The innovation data of China’s automotive power battery industry shows that due to the epidemic situation in Shanghai, China from January to April, the installed capacity of domestic first-tier manufacturers has dropped significantly, and some second-tier power battery manufacturers are also striving to gain more market share.

At the same time, more and more OEMs have begun to build their own battery production capacity.

The evolution of the competitive situation in the power battery industry

The reason for the decline in the market share of some lithium power battery manufacturers is the wider application of lithium iron phosphate power batteries(Lifepo4 batteries).

As more car companies choose lithium iron phosphate batteries with more advantages in terms of cost, data shows that in April, the installed capacity of lithium iron phosphate batteries reached 8888MWh, a year-on-year increase of 177.2%, which is the current four mainstream power battery types, and Lifepo4 battery is the only lithium battery variety that has achieved year-on-year growth.

From January to April, the installed capacity of lithium iron phosphate batteries reached 38,723MWh, a year-on-year increase of 207.5%, much higher than the 35.4% increase of ternary batteries.

The rising price of raw materials for lithium batteries has forced lithium battery manufacturers to accelerate the research and development of new materials, and the market share of traditional ternary batteries will inevitably be affected, said a power battery industry analyst.

Lithium manganate batteries

In addition to lithium iron phosphate, lithium manganate batteries with high cost performance are also valued. The data shows that at present, the installed capacity of lithium manganate batteries is rising.

From January to April, the installed capacity of lithium manganate batteries reached 68.7MWh, a year-on-year increase of 112.3%, becoming the category with the highest increase after lithium iron phosphate batteries.

However, a sudden change in the installed capacity of one or two months does not explain the problem. Because some battery manufacturers sell at a price lower than cost to achieve shipments in order to seize market share , and this phenomenon cannot last for a long time.

At a time when the cost of raw materials continues to rise and lithium iron phosphate batteries are more favored by car companies, second-tier battery manufacturers are speeding up to seize market share.

In addition, in order to ensure the stable supply of batteries, car companies have gradually shifted their relationship with battery companies from a single supplier to multiple suppliers, which has also brought development opportunities for second-tier power battery companies.

Whether in the field of ternary batteries or lithium iron phosphate and other categories, the shipments of second-tier power battery companies are constantly increasing, which is due to the strategic cooperation between OEMs and second-tier power battery companies.

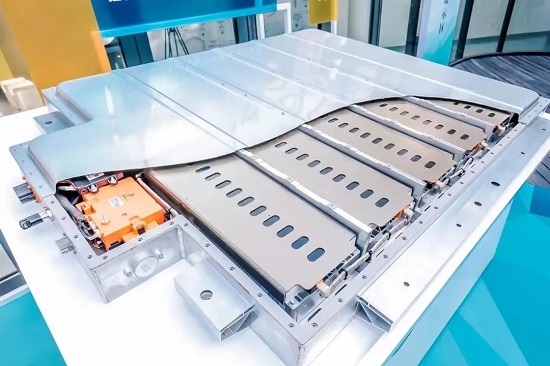

During this process, the competition in the lithium battery industry has intensified, intellectual property lawsuits have occurred from time to time, and OEMs have also begun to participate in the production of batteries. Including the establishment of R&D laboratories engaged in the research and development of lithium-ion cells and battery packs, as well as the construction of pilot production lines for lithium-ion cells and battery pack mass manufacturing lines.

From the perspective of the global new energy vehicle industry, OEMs have begun to build their own power battery production lines, including Volkswagen, Mercedes-Benz, Honda, Tesla and other international manufacturers.

More and more OEMs have begun to build their own battery factories because the battery as the core components of new energy vehicles, OEMs hope to have some self-production capabilities, and self-produced batteries also help auto OEMs to be more secure in the supply chain.

It can be said that the competition in the power battery market is fierce, but this is a necessary stage for the development of a new industry. In the power battery industry, more and more companies will join, and the competition will only become more intense, which is one of the important reasons for driving technological progress.

However, in the current field of lithium-ion battery technology, the current strong and weak ecology is difficult to shake in the short term, because on the basis of this generation of lithium battery technology, it is difficult for second-tier power battery manufacturers to have a big impact on the leading position of first-tier power battery manufacturers, because the quality of power batteries of first-tier manufacturers is beyond doubt, and it is difficult for other second-tier battery manufacturers to compete with them.

CATL’s good cost and QC

In addition, relying on the advantages of scale, first-tier manufacturers, such as CATL, have achieved good cost and quality control, which is also unmatched by other battery manufacturers.

First-tier OEMs pay more attention to battery quality. Short-term market fluctuations, including rising raw material prices and other factors are only a temporary phenomenon. In the long run, OEMs will be more willing to choose products like CATL with more guaranteed quality.

At the same time, CATL is also adopting a strategy of jointly producing batteries with OEMs, which will also play an important role in its continued growth. CATL has also noticed OEMs’ concerns about the security of the battery supply chain, so it is also trying to cooperate with OEMs to help OEMs achieve the goal of battery supply chain security.

It is not easy for OEMs to make their own batteries. They prefer to choose joint ventures with power battery companies, and working with CATL is definitely the first choice for more OEMs.

Future uncertainty

However, with the further improvement of battery technology in the future, it is difficult to judge what kind of changes will be made in the industry after semi-solid batteries and solid-state batteries are launched.

In the field of semi-solid batteries, although some battery companies are at the forefront, it is difficult to form a scale in the short term. Semi-solid batteries may start to increase shipments next year.

At that time, it is difficult to judge what will happen to the competitive landscape of the power battery industry. However, at the current level of battery technology, CATL is likely to remain its industry leader status.