In 2021, the supply of many materials for lithium batteries will be tight and prices will soar, causing cross-border entrants to flock to the market.

Especially in the sector of LFP materials, in addition to traditional LFP cathode material enterprises, including the companies of ternary cathode material, phosphorus chemical , titanium dioxide chemical, etc. have also joined the trend of LFP material expansion.

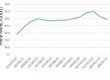

Lithium Battery Metal Materials

For traditional material companies, the more new entrants and the more new production capacity, the market competition and price impact are bound to intensify.

LFP materials

Taking LFP materials as an example, only companies with integrated projects, rapid production expansion, cost advantages, and deep binding with customers are expected to enjoy the continuous survival and development of the industry’s high prosperity stage.

However, the performance requirements of batteries have improved, new technologies have emerged one after another, and the threshold for material companies has become higher and higher.

For example, due to the need to increase the energy density of power batteries, reduce manufacturing costs, and improve safety performance, higher requirements are placed on the product performance improvement of lithium battery materials such as cathode materials, anode materials, separators, electrolytes, copper and aluminum foils, and battery structural parts.

At the same time, power battery companies are constantly exploring material innovation capabilities, such as sodium-ion batteries and M3P batteries in the CATL.

Therefore, breaking through the bottleneck of product performance and developing new materials has become a new challenge for lithium battery material enterprises to be solved urgently.

In other words, the barriers to competition in the lithium battery material industry will continue to rise.

Based on the stable supply and price of raw materials, more and more battery companies have begun to directly carry out diversified cooperation with the most upstream material companies.

Even OEMs have begun to try to bypass battery companies and directly participate in the global bidding for lithium, cobalt, and nickel resources.

It can be seen that in the ever-changing market environment, the new ecology of the lithium battery industry chain is also constantly being formed. How to deal with the relationship with terminal enterprises in the situation of short supply and oversupply, material enterprises need to respond to market changes with more foreword new thinking

+8613906047998

+8613906047998