Since the price of lithium carbonate fell on November 22, the market price of lithium carbonate has continued to fall, but the enterprises in the industrial chain there are still investing heavily. A number of listed companies have continued to increase their stakes, and tens of billions of projects have been launched frequently.

Since the beginning of this year, due to the shortage of lithium ore, lithium carbonate has been a hot spot in the battery industry.

Paradox Lithium Carbonate Prices Fall and Money Influx

Soaring Price

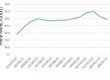

At the beginning of the year, the price of battery-grade lithium carbonate was about 280,000 yuan/ton, which rose rapidly to 500,000 yuan/ton in March this year, and remained at a high price of more than 460,000 yuan/ton in the following months. In mid-September, the price of battery-grade lithium carbonate once again exceeded 500,000 yuan/ton, and once exceeded 600,000 yuan/ton. Then, the price of battery-grade lithium carbonate began to fall, and the average price of battery-grade lithium carbonate fell below 550,000 yuan/ton .

In addition, according to reports, the average price of spodumene in 2021 is only US$598/ton, soaring to US$2,730/ton in 2022, and will further rise to US$4,010/ton in 2023. But in 2024, the price of spodumene will fall back to 3130 US dollars / ton.

On November 23, a number of mineral resources development, new energy industry development and other projects announced the creation of a “low-carbon” industrial park for the entire lithium battery industry chain, including lithium carbonate production, related lithium salts, new energy power station development, battery cathode material production, 10 Integration of 10,000 tons of artificial graphite anode materials, 10GWh lithium battery manufacturing, battery PACK and public energy storage power stations, and charging and swapping stations.

Rough Statistics

The lithium-containing polymetallic open-pit mining, lithium carbonate and battery project invested by DZ Mining is expected to have a total investment of 16 billion yuan. Lithium carbonate mining and dressing and pipeline transportation, new building materials production base and 160,000 tons of lithium iron phosphate cathode material production base.

Saiku invested in the construction of two battery-grade lithium carbonate production lines with an annual output of 10,000 tons, with a total contracted capital of 5 billion yuan. After the project is put into normal operation, the annual output value is expected to reach more than 10 billion yuan.

Sunwoda has invested a total of 16.5 billion yuan in the construction of projects such as lithium salts, lithium battery materials, and lithium battery recycling, building an industrial chain system from lithium carbonate production, lithium battery key materials to lithium battery recycling, and building an annual output of 300,000 tons of cathoude materials project, comprehensive recycling project with an annual output of 50GWh, and a battery-grade lithium carbonate project with an annual output of 50,000 tons.

Anzhong invested in lithium-containing polymetallic ore mining and dressing, lithium carbonate, hybrid energy storage and battery projects, with a total investment of about 26 billion yuan. Lithium carbonate processing projects totaled 10 billion yuan, and hybrid energy storage and battery projects totaled 16 billion yuan.

Among them, the battery-grade lithium carbonate construction project is divided into three phases. The first phase is to build a battery-grade lithium carbonate production line with an annual output of 20,000 tons; the second phase is to build a battery-grade lithium carbonate production line with an annual output of 20,000 tons; the third phase is to build a production line with an annual output of 410,000-ton battery-grade lithium carbonate production line.

Anzhong and the enterprise consortium will jointly invest in the construction of a 40GWh hybrid energy storage and battery project, which will be constructed in three phases, of which the first phase will build a 10GWh hybrid energy storage and battery project; the second phase will build a 10GWh hybrid energy storage and battery project; The third phase of construction of 20GWh hybrid energy storage and battery project

In addition, the company also plans to invest in the construction of a lithium carbonate smelting production line with an annual capacity of 50,000 tons. The first phase is a 25,000-ton lithium carbonate smelting production line project, and the second phase is a 25,000-ton lithium carbonate production line project.

The above investments are all focused on building a “low-carbon” industrial park for the entire lithium battery industry chain. The construction content covers lithium carbonate, lithium salt, lithium battery manufacturing, battery PACK, public energy storage power station investment, etc. The project contains lithium polymetallic ore mining, Lithium carbonate, hybrid energy storage and batteries, lithium salts, lithium battery materials, lithium battery recycling,etc.

Not Contradictory

On the whole, the current contradictory lithium carbonate market is not contradictory. After all, lithium carbonate, as one of the important raw materials for lithium batteries, accounts for about 15% of the cost of batteries. In 2023, the sales volume of new energy vehicles in China will reach 900 million, a year-on-year increase of 35%. With the outbreak of demand for new energy vehicles, the market demand for battery grade lithium carbonate is still strong.